Contact Casey Lamb

10-20-2025 Update

Status Update

Dear Casey,

I first have to say how thankful I am for all of your insight and direction. I have updated this entire page to try to give you access to everything I have and have learned since we last spoke.

Access to Accounts (Personal & Business)

After I called the IRS they let me know that the only way they could release any records over the phone was via Fax Machine. They helped me confirm my account setup online but am now waiting 10 business days for a pin to come to my personal address. Once I have the pin I can access all of my transcripts and all of the information you requested in my online portal. As soon as I have, I will upload here.

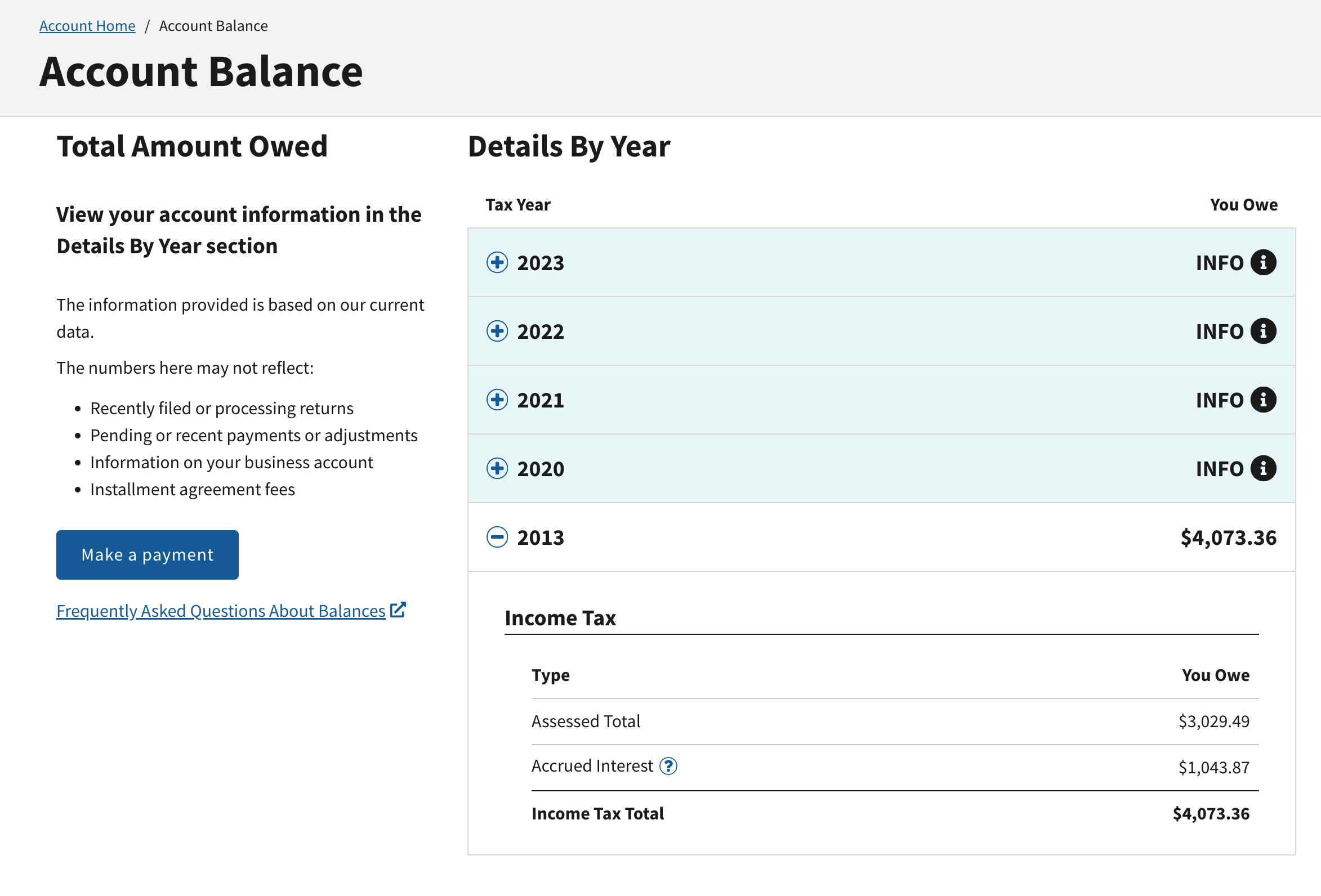

I have access to my personal account and have updated everything I have access to below. under the “Individual Taxes” Section. On my personal taxes it is now saying I have a $1000 dollar late penalty See below “Account Balance 2025”

Archived: 10-6-2025

-

I’m here because I need professional help sorting through several years of unfiled or uncertain tax situations — both personal and business. I’ve reached a point where I can’t manage it on my own. My goal is to get completely organized, understand exactly what I owe, and create a realistic plan to make things right.

I’m not coming in with a massive budget, but I’m committed to doing this the right way — and to building a long-term relationship with a tax professional or firm that can guide me over time. I want to get out of survival mode and move toward financial stability, both for myself and for my two children.

My situation involves multiple layers — unfiled personal returns, overdue corporate filings and fees, business and personal expenses mixed together, debt, and a pending divorce — and I need help untangling it all in a structured and judgment-free way. My hope is to find someone who can help me start fresh, create order from the chaos, and establish healthy financial habits moving forward.

-

Determining what I owe for personal and business taxes (federal and state).

Filing missing returns for all relevant years.

Creating smart payment plans with the IRS and the State of California.

Closing the inactive corporation properly.

Setting up clean bookkeeping and separating personal vs. business spending.

Getting advice on managing and prioritizing debt payments.

Understanding what needs immediate action vs. what can wait.

INDIVIDUAL TAXES

LAST UPDATED: 10-20-2025

Personal Information

Name: Jonathan Patterson

D.O.B: 3-12-1985

Address: 26 Jefferson Irvine CA, 92620

Personal Tax History

I have no memory of ever filing or paying my personal income taxes for both W-2 and freelance work.

I may have multiple missing or unfiled returns.

I have two children I can claim as dependents:

Hiro Eden Castle Patterson — born June 23, 2009

Akira Ohana Winter Patterson — born January 13, 2021

Debt & Cash Flow

I’m maxed out on all credit cards and have over $20,000 in personal debt.

I pay most personal bills and expenses through my business account, which has blurred financial lines.

Additional Personal Context

I’m currently going through a divorce, which will affect my financial situation.

I’ve been under severe stress and sleep deprivation from trying to manage this alone.

IRS WEBSITE (Individual)

Return, Wage & Income Transcripts (10-20-2025)

When I click on any of the PDFs it brings up the error below. I was able to download them as of 1-19-2025 but for some reason I can no longer. See below:

Account Balance (10-20-2025)

Employment 2024 W2

BUSINESS TAXES

LAST UPDATED: 10-20-2025

Corporate Information

Business Taxes & Filings

I have not paid any taxes for my active corporation.

I have not paid the required $800–$900 annual California corporate filing fees for multiple years.

I have a second corporation that has never been active and needs to be formally dissolved.

Bookkeeping & Records

I have a QuickBooks Online account but don’t know how to use it.

My bookkeeping is incomplete and needs to be reviewed and reconciled.

IRS WEBSITE (Business)

Access to Account

After I called the IRS they let me know that the only way they could release any records over the phone was via Fax Machine. They helped me confirm my account setup online but am now waiting 10 business days for a pin to come to my personal address. Once I have the pin I can access all of my transcripts and all of the information you requested in my online portal. As soon as I have, I will upload here.